are delinquent property taxes public record

An owner whose property is. Secure Searches Payments.

Tax Deed Sales Phil Diamond Orange County Comptroller

Interest of 56 of 1 per month plus 2 penalty must accompany delinquent taxes paid after due dates.

. The Tax Office accepts full and partial payment of property taxes online. Ad Looking for Corinth Tax Records. Average Property Tax Ontario.

Once a property tax bill is deemed delinquent after March 16th of each year a 15 past due penalty is added to the bill and the bill is sent to the Delinquent Tax Office. There is no charge for searching the records however there is a 200 charge to get detailed information. If your unpaid taxes have been sold at an annual tax sale scavenger sale or over the counter the Clerks office can provide you with an Estimate Cost of Redemption detailing the amount.

Publication of Delinquent Real Estate Taxes. A 3 minimum mandatory charge and advertising charge is imposed on April 1. The property owner may retain the property by redeeming the tax deed application any time before the property is sold at public.

Have not paid their taxes for at least 6 months from the day their. Delinquent homeowners who receive a Basic STAR benefit must pay delinquent property taxes in full by this date. Get In-Depth Property Reports Info You May Not Find On Other Sites.

Westmoreland County added more than 162 million to its coffers Monday from the sale of tax delinquent properties. Delinquent Taxes and Tax Foreclosure Auctions. Pay Personal Property Taxes.

Pacific Time on the delinquency date. This is my first time to use this service so I wasnt sure how many questions I can askWith business closed and no property for Dallas County to pursue what. You may search by.

Prior to current year delinquent taxes being put in the delinquent records of the County Treasurer they are published in a county newspaper of. Find Owners Info Property Value Details Sales History More. These lists outline property addresses where the property owners have fallen behind.

Suit Number Parcel Number Property Address Record Owner or. This site allows public access to Delinquent Land Tax Sale information. According to the most recent data from the Canadian Revenue Agency the average property tax rate in Ontario is 138.

Denyel OBrien director of the countys tax office said. If payment is not received at the Tax Collectors office before June 1st a. 1 S Main 2nd Floor Mount Clemens MI 48043.

For an official record of the account please visit any Tax Office location or contact our office at 713-274-8000. 1 day agoUnion County Tax Assessor-Collector Tameri Dunnam reported to Union County Supervisors that the annual sale of property with delinquent property tax due went smoothly. 112 State Street Room 800 Albany NY 12207.

All taxpayers on this list can either pay the whole liability or resolve the liability in a way that satisfies our conditions. NEW BOSTON Texas -- Sixty tax-delinquent properties in Bowie County are now up for sale. This amount must be obtained by contacting the Treasurers office.

Delinquent Real Estate Taxes. 30 days after the mailing date of the letter in Step 3. Pay Real Property Taxes.

A delinquent tax list is a public record and kept on file with your local county clerk. A tax lien is a legal claim against real property for unpaid municipal charges such as property taxes housing maintenance water sewer demolition etc. Search Anywhere On Any Device.

Commissioners agreed Monday to give Bowie Central Appraisal District the. The specifics about each countys sale along with a listing of each certificate of delinquency are required to be advertised in the local newspaper at least 30 days prior to the tax sale date. Ad Full Property Reports.

Marquette County Delinquent Tax records are available on-line.

Look Up Your Property Tax Bill Multnomah County

The City Borough Of Sitka Alaska Assessing

Florida Dept Of Revenue Property Tax Data Portal

Tax Payment Inquiry Washington County Pa Official Website

Listing Management Public Records Solutions Corelogic

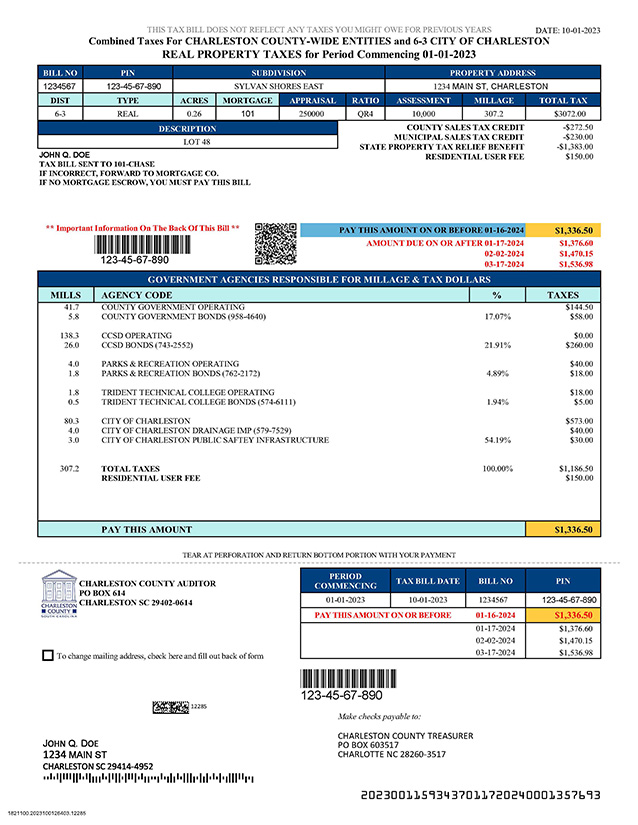

Sample Real Property Tax Bill Charleston County Government

Dallas County Tx Property Search

Property Records Taxes Savannah Development And Renewal Authority Sdra

One Of The Steps In Buying A Home Is To Have A Title Search Completed Prior To Closing Many First Time Buyers May Not Have H Title Insurance Title Home Buying

How To Find Tax Delinquent Properties In Your Area Rethority

Teller County Property Records Database

2022 Property Taxes By State Report Propertyshark

How To Perform A Property Records Search In California We Lease San Diego

Charlotte Foreclosure Notice Sell House Fast Sell House Fast Foreclosures Selling House

Property Tax Search Taxsys Broward County Records Taxes Treasury Div

Property Records And Taxpayer Services Todd County Minnesota